280+ Vintage 1: The Fundraising Exercise

Curation & discovery for the long tail, instrumentation for enterprise services

I mentioned this in the tweet announcing my newsletter, but I’ve felt as if I needed a forcing function to publish content on a regular basis for some time now. There are a few merits to writing at a defined rhythm — it’s good hygiene and the consistency gives way to a larger audience over time. I’d like to use this particular space for thoughts that go beyond 280 characters and on the other end, use native content on my existing site for in-depth analysis.

Calorie Counting

In the seed stage market bubbling up around us (dare I say…frothy?), there is a substantial subset of founders with the ability to choose who their investors are. Within that cohort, there is a smaller proportion who have term sheets from top-tier firms flying their way, and they can be *very* picky about choosing their investors. It’s a nice position to be in.

Some of these founders believe that fundraising and speaking to investors is not mission-critical to their business. They want to get financing out the way as soon as possible (because they know they have ownership over the timeline and process) to move towards company building. I understand this position, as many investors drag their feet, could be duds, and for the most part, waste time.

Yet, fundraising is not a practice distinct from company building — it is a function within it. Fundraising not only allows one to narrow the narrative scope of the business, but also creates a pool of personalities that one is exposed to. If you cast a wider net and spend a concentrated amount of time in the venture market, you can select an individual investor that meshes better with you and your business.

This sounds nice in the theoretical and handy-wavy vacuum, but I’d urge early-stage founders, especially those who know the cards are in their hand, to think hard about how much time they want to spend in the financing markets. Our partner Semil characterizes the fundraising motion as “burning calories” with some of the founders we work alongside at Haystack.

Founders should set a budget for and count calories accordingly prior to and through the fundraising process — be thoughtful about the time spent doing it and monitor the interactions throughout. The number of calories one wants to burn ultimately boils down to personal preference and appetite. Yet, if you burn the calories early, you’ll set a strong foundation for fitness in the long run.

Long Tail Discovery

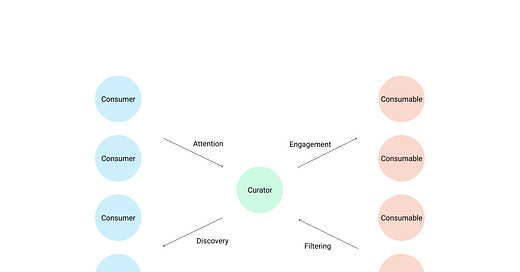

For many mass consumables — content, music, fashion brands — there are a few big players in each category with a long tail of not-as-popular, but specialized and unique assets. This presents a marketplace problem centered around discovery. On one end, there is supply trying to connect with passionate fans or consumers. With respect to demand, there are consumers frustrated with stale options, seeking distinct options that map to their tastes.

In music, Spotify tackled this problem through their discovery layer, which subsequently became one of their competitive advantages. They’ve advanced work in recommendations and machine learning, but that’s not the part that intrigues me. There’s an emerging ecosystem of playlist curators that select emerging indie artists and distribute them to their own audiences. These curators are willing to do the work of sifting through tons of content to find the right pieces that will resonate with an audience.

Many of these curators have manual processes to sift through tons of content and information that comes to them. Matt Levine, who runs a popular finance newsletter, details some of his work process in this podcast with David Perell. There’s a growing contingent of influencers or creators willing to look through the long tail, and I wonder if some of them are willing to pay for tools that enable them to manage their audiences and pour through information streams. We’ve also seen curation ecosystems emerge for digital media (news, music, etc.), but I’d be curious to see how it plays out for the long tail of D2C brands (especially as they grasp for more cost-effective acquisition channels).

If you’re interested in this subject, I would recommend following Aaron McClendon (@faintflex) and Benedict Evans (@benedictevans).

Enterprise Services — The Marketplace Tilt

There’s a rush of B2B software companies being built that cater to product-first orientation, bottoms-up adoption within organizations, along with a consumer-centric UI and feel. One of the concerns with these models is that they can scale quickly in the first few years, but hitting non-linear revenue growth becomes difficult if you can’t sell top-down into large enterprise clients.

As you sell a service into more complicated and larger organizations, the nature of the service becomes more bespoke and less productized (adding custom integrations, booking services revenue). For certain product areas, how do you scale and serve large clients without turning into a non-scalable services business yourself?

There may be a tipping point where the ideal solution goes from a productized software tool to a marketplace that opens up a host of providers, who can offer services tailored to the needs of a client. This is all a fancy way of trying to explain how B2B marketplaces work and emerge, but it’s a thread I want to continue pulling on.

If you have any thoughts, feel free to DM me on Twitter. All my writing can be found on my personal site.