In the late fall of 2024, our friend Kevin Mahaffey sent us some background information on a team he had backed – founders working on what was described as an “operating system for home building.” The company was Type Five. Even as a seed stage company, they had already built several customized, backyard ADUs (accessory dwelling units) and homes in the East Bay in Northern California.

I’ll admit that my partner Semil and I were initially skeptical. We remembered the wave of companies from years back working on modular construction tech or helping consumers build ADUs. Most never lived up to their promise – they were often too capital intensive, couldn’t make the unit economics work, and thus were never able to achieve meaningful venture scale.

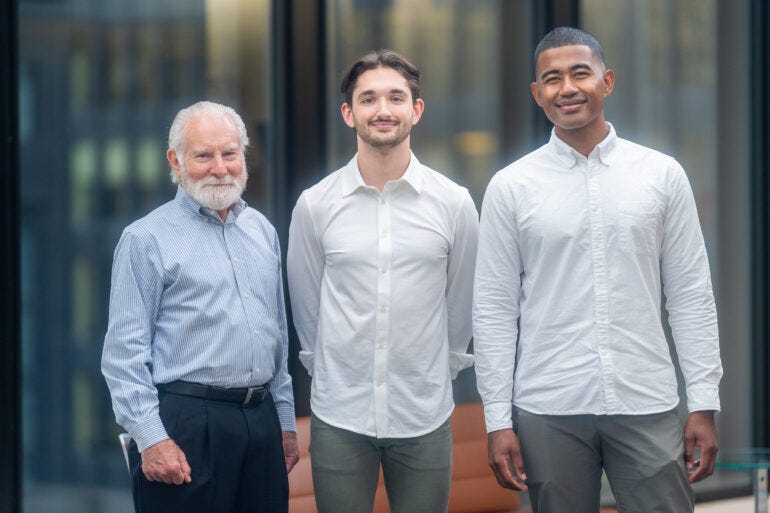

Yet, we noticed how thoughtful their pitch materials were, and as we looked further, saw that the Type Five team had already accomplished so much, even with a limited amount of capital. They’d cultivated a great brand and reputation with the homes they had built for families across the Bay Area, with many more on the way. We decided to dig in. We spent time getting to know the founders, Tim and Aleksis, through a series of Zooms and a long, rainy afternoon in Berkeley.

We came away very impressed. The pair had spent a lot of time meticulously mapping and studying the construction tech market. How could you build the next Lennar? What would enable it to scale in a capital efficient way? What were the common patterns of companies that didn’t work? Tim and Aleksis were well ahead of any of our objections. They complemented each other very well, striking the right balance of wildly optimistic and intentionally pragmatic. Lastly, it was clear that much of their shared purpose for Type Five stemmed from their deep ties to the Bay Area and a passion for building the next starter home for millions of young Americans that can’t afford a home where they live and work. Tim and Aleksis originally met as undergrads at Cal years ago, and are proud to have started their company in the East Bay, serving their communities first.

So what makes Type Five exciting—and why do we believe they have a real shot at becoming America’s leading tech-enabled homebuilder?

Each home or structure is unique, but is composed from the same set of building blocks. Type Five avoids the capital costs of centralized production and manufacturing that the last generation of ADU builders faced – they instead provide local contractors with a consistent and predictable system to stand up homes. Over time, any contractor across the US should be able to stand up a Type Five build cost effectively.

Their internal parametric design software Formwork generates permit-ready plans for a range of structures. Rather than selling Formwork as a tool to developers or contractors, Type Five integrates it into a full-stack product—capturing more value and streamlining the build process from design to completion.

Type Five has already proven to be multiples faster, cheaper, and less labor intensive than traditional construction. For contractors, they also provide higher revenue per project and increased availability of jobs. In a country facing a deep and chronic housing shortage, Type Five has the potential to materially improve the cost of living.

Today, Type Five announces their seed round, and Haystack is delighted to lead alongside Village Global and SNR. They are expanding rapidly, but if you find yourself in Berkeley or Oakland, I’d highly recommend stopping by one of the builds.